What's Next for

DeFi Insurance?

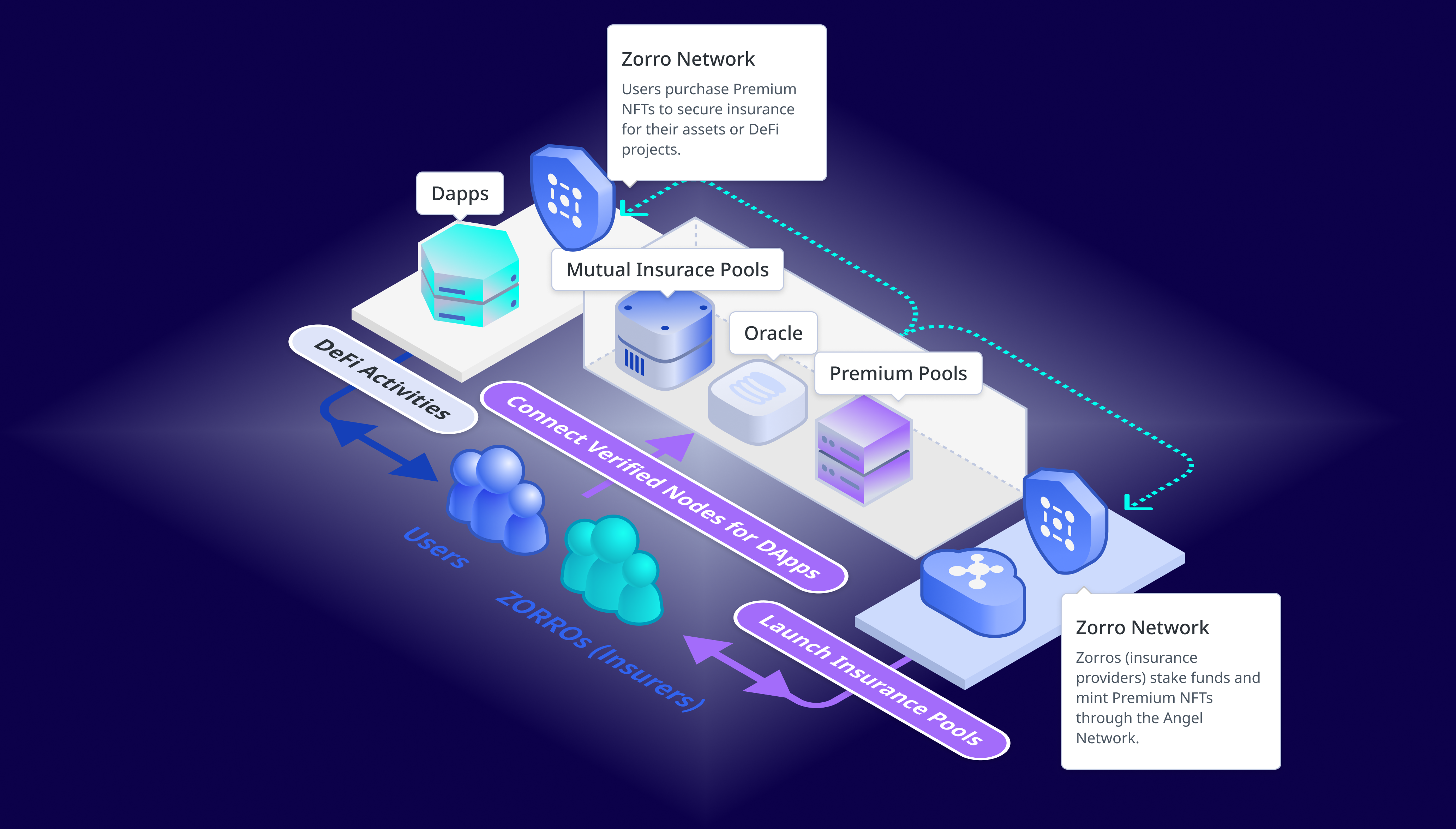

We're now building the P2P Insurance Swap Network

P2P Insurance Swaps: Trade Coverage Like a Token

Trade insurance coverage as easily as swapping tokens.

Secure dynamic plans for unlimited DeFi use cases.

Adapt coverage for assets like stablecoins, NFTs, staking, and beyond.

Easily launch insurance pools or get insured, for everyone in DeFi.